Oman has just made its new Golden Visa program more attractive for investors. Just imagine how beneficial the changes are: more investment routes, 10-year residency, and a lower threshold.

In this article, we’ll cover the main changes of the new Oman Golden Visa, its benefits, challenges, risks, and costs.

Key Takeaways

- At the end of August 2025, Oman announced some major changes in its New Golden Visa program. Instead of the previous 3 main investment routes, the country now offers 7 investment paths.

- The minimum amount of investment in the new program is OMR 200,000.

- The 7 investment routes are real estate (ITC = integrated tourism complex), business formation, government development bonds, Muscat stock exchange shares, fixed-term bank deposit, business with Omani employment, or foreign capital investment law nomination.

- The main benefits of the Golden Visa program are longer, secure residency terms, flexibility of investment options, lower barriers for some investors, family inclusion, and no requirement for a local sponsor.

What’s New in Oman’s Golden Visa 2025?

On August 31, 2025, under the Ministry of Commerce, Industry, and Investment Promotion (MoCIIP), it was announced that the Oman Golden Visa has been updated. Earlier, Oman offered 2 residency tiers:

- 5-year permit, which required at least OMR 250,000 investment,

- 10-year permit, which required at least OMR 500,000 investment.

Applicants, who were interested in the program, needed to make the appropriate amount of investment in one of the 3 main routes: company equity, real estate, and government bonds.

Oman investor visa changes replaced these two tiers with a broader perspective. The investment threshold for the 10-year residency permit became even lower. Now, interested applicants need to make at least OMR 200,000 in one of the following options:

- Real estate (integrated tourism complex),

- Business formation,

- Government development bonds,

- Muscat stock exchange shares,

- Fixed-term bank deposit,

- Business with Omani employment,

- Foreign capital investment law nomination.

The Seven Investment Routes

In the new Golden Visa program, 10-year residency permit, applicants can acquire residency if they invest at least OMR 200,000 in one of the following seven options:

Real Estate (Integrated Tourism Complex)

If you choose this path, you’ll need to invest at least OMR 200,000 in purchasing approved residential, commercial, or hotel property in a government-designated Integrated Tourism Complex (ITC). After the purchase, you’ll also need to register the real estate with the Ministry of Housing and Urban Planning.

Business Formation

Choosing business formation means you’ll either need to establish your own company in Oman or invest in an existing one. You’ll need to keep the company active, maintain the required capital, and make sure all taxes, licenses, and filings are up to date.

Government Development Bonds

You can invest in Omani government development bonds and keep them for the required period. You’ll also need to show proof of purchase and pass the bank’s verification checks.

Muscat Stock Exchange Shares

You can buy shares listed on the Muscat Stock Exchange and keep your investment at least OMR 200,000.

Fixed-term bank deposit

You can make a fixed-term deposit in an approved Omani bank for the required amount of time, and meanwhile keep proof of the funds.

Business with Omani Employment

You can qualify by running a company that employs at least 50 Omani nationals and follows all local labor and payroll rules.

Foreign Capital Investment Law nomination

The last option of getting a Golden Visa is being nominated as a key employee or partner by a company regulated under the Foreign Capital Investment Law, as long as your investment remains valid.

Costs & Fees

The cost of getting the Oman Golden Visa depends on the chosen investment route and the number of dependents included in the application. While Oman has made the investment entry threshold more accessible, applicants should still be aware of several related costs and fees involved in the process.

Minimum Investment Requirement

As of 2025, the minimum amount of investment to acquire an Oman Golden Visa is OMR 200,000. The investment must be made in one of the following routes: real estate (integrated tourism complex), business formation, government development bonds, Muscat stock exchange shares, fixed-term bank deposit, business with Omani employment, or foreign capital investment law nomination.

Government Application Fee

Applicants should pay a non-refundable government processing fee, which is typically OMR 300-500 per person.

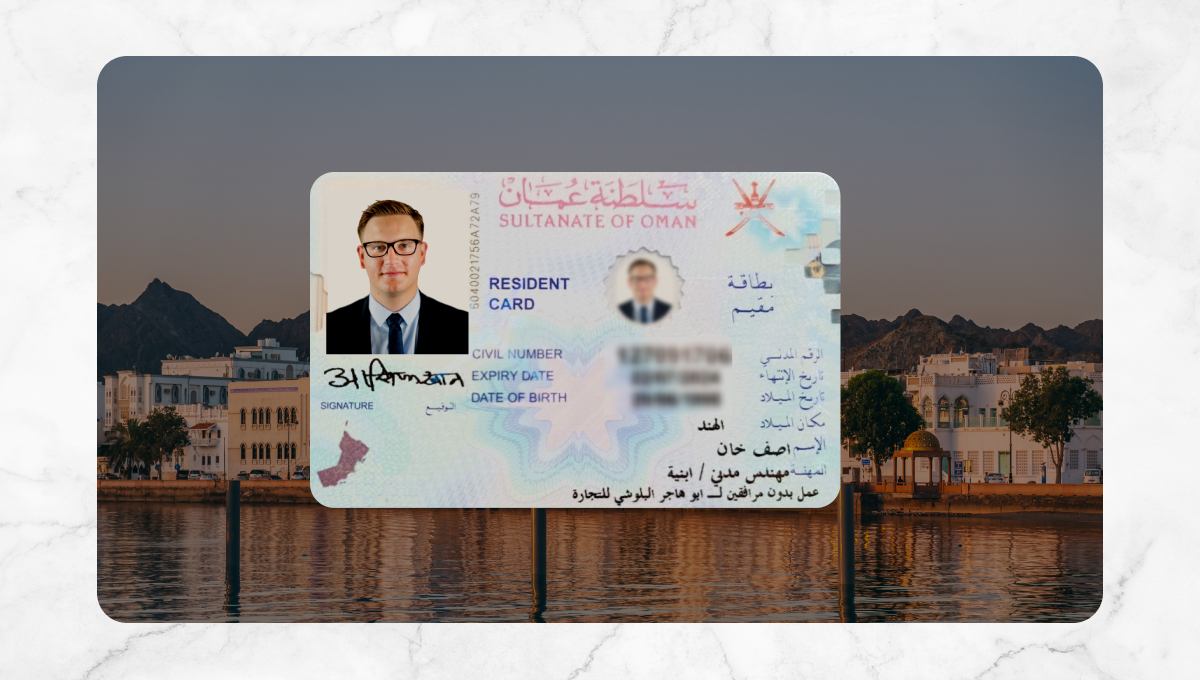

Residency Card Issuance Fee

After the approval, each of the family members (who have been included in the application as dependents) needs to pay around OMR 100-150 for the administrative costs of residency documentation and ID cards.

Medical and Background Checks

All the applicants need to pay OMR 30-50 per person to undergo a medical fitness test and security clearance.

Benefits of the Golden Visa

Oman's new Golden Visa offers a lot of benefits that attract foreign investors, professionals, and entrepreneurs who are interested in getting a long-term residency. Here are the key advantages, particularly after these updates:

Longer, Secure Residency Terms

The new Oman Golden Visa program offers a 10-year residency, which gives investors more security and stability.

Flexibility of Investment Options

The previous Golden Visa program had only 3 types of investments that would guarantee the residence permit. Thanks to 2025’s updates, Oman new Golden Visa offers 7 types of qualifying investments, including not just property or business equity, but also bonds, retirement income, etc.

Lower Barrier for Some Investors

The minimum amount of investment for Oman Golden Visa is 200,000 OMR, which is more affordable and attainable for more investors than what was required in older schemes.

Family Inclusion & Dependents

Those who apply for the Oman residence visa can also include their immediate relatives, such as their spouse, children under 25, and parents, in the application.

No Requirement for Local Sponsor

Investors and their relatives can apply for the Golden Visa program without needing a local sponsor, which makes the process much easier.

Application Process

Applying for the Oman Golden Visa can be a bit overwhelming, especially considering the fact that the program has undergone some major changes lately. This means that the process involves a thorough document preparation and guidance to avoid delays or rejection. Here are some steps that you’d need to follow:

Consult With an Authorized Company

To make sure that the application process goes smoothly and you are aware of the latest MoCIIP regulations, we advise you to apply through an officially recognized service provider such as Mirabello Consultancy.

Determine Your Investment Route

As we’ve already mentioned in the article, there are 7 investment paths in this new Oman Golden Visa program. Decide which one you want to follow. Remember that the chosen path will determine which documents and approvals you’ll need to prepare.

Prepare Financial Documentation

Gather all the required documents, starting from those that prove your investment capacity and the source of funds. The list of documents also includes bank statements, investment certificates, tax returns, and property or company ownership records.

Submit Application to MoCIIP

When all the documents are ready, our experts will submit the application to the Ministry of Commerce, Industry, and Investment Promotion (MoCIIP). The submission typically includes your investment proof, identification documents, and residency application forms.

Verification and Background Checks

Once the authorities receive your application, they’ll start a background check and financial verification to confirm that your investment meets all the requirements. This step may also include checks for legal, tax, or compliance issues.

Receive Conditional Approval

If during the initial review, everything in your application is clear, you’ll receive a conditional approval, which means that you can make the actual investment.

Final Approval and Residency Issuance

After completing the investment and providing final proof of compliance, your Golden Visa will be officially issued. You will receive a residency permit valid for up to 10 years.

Potential Challenges and Considerations

While Oman’s new Golden Visa program gives a lot of benefits, you should keep in mind that it also comes with some challenges. Taking these considerations into account means you’ll have a smoother application process:

High Investment Threshold

As we’ve already mentioned before, Oman previously had 2 main tiers. For the first tier, you needed to invest at least OMR 500,000, and for the second tier, the minimum amount of investment was OMR 250,000. It’s true that currently, thanks to the changes, the threshold is a bit lower: now it’s OMR 200,000. However, not everyone can make the investment because it’s still not that affordable.

Proof of Funds and Source Verification

As an applicant, you need to provide full documentation of where your investment funds come from. This includes bank statements, tax records, and proof of ownership. Incomplete or unclear documentation may delay approval.

Regulatory and Legal Compliance

Before applying for Oman’s new Golden Visa program, investors need to get acquainted with Omani laws related to foreign ownership, business registration, and taxation. Working with a local legal or business consultant can help streamline these processes and avoid costly mistakes.

Market and Investment Risks

While Oman investment environment is steady, investors need to be aware of the fluctuations in sectors like real estate and the stock exchange. Property prices depend on tourism performance, and stock investment can be changed because of economic shifts and oil market trends.

Limited Citizenship Pathway

While the Golden Visa program can grant an Oman residency, it’s important to remember that Oman maintains strict nationality laws, meaning that, unlike some other countries, holding an Oman Golden Visa does not automatically lead to Omani citizenship.

Residency Maintenance Requirements

All the applicants need to pay attention to residency maintenance requirements. One of the most important requirements is to maintain their qualifying investments throughout the visa period. Selling property, withdrawing funds, or failing to meet employment requirements (like the 50 Omani employees condition) could risk non-renewal.

Application and Renewal Process

Despite the fact that Oman has introduced online systems to simplify the process, applicants may still experience delays or require legal assistance for documentation, company registration, and renewals.

Local Integration and Adaptation

The adaptation process to Oman’s lifestyle, culture, and regulations can take some time, especially if you don’t have any experience with the Gulf region. However, learning the language could really loosen a tie.

Conclusion

Oman’s Golden Visa program became more investor-friendly and globally competitive in 2025. With lower investment thresholds, expanded options, and family-friendly policies, it’s now easier than ever to build a secure future in one of the Gulf’s most stable and welcoming nations. If you’re considering applying, working with trusted experts who will make sure your application is compliant with all the requirements.

FAQ

No, acquiring an Oman Golden Visa doesn’t automatically grant you visa-free access to GCC countries. To enter those countries, you’ll need to obtain the appropriate visa.

Yes, an Omani Golden Visa holder can work for another company or even establish their own business in Oman. Acquiring a Golden Visa gives you lots of benefits, starting from the freedom to live, work, and invest without being tied to a single local sponsor.

Yes, according to Oman's Foreigners' Residence Law, Golden Visa holders can lose their Oman residency if they stay outside the Sultanate for more than six continuous months or eight non-continuous months within a year, or 18 months within a three-year period.